World Mental Health Day on October 10th is designed to promote greater awareness of issues around mental health and to help remove the stigma that can surround it.

Mental health problems are more common than many people imagine, particularly in later life. The Mental Health Foundation estimates that 22% of men and 28% of women over 65 suffer from depression. So, what are the most important factors in maintaining good mental health in later life?

Relationships

Good personal relationships are well known to promote better mental health. All normal human interactions affect the levels of chemicals such as serotonin and oxytocin.

Serotonin is important for general mental wellbeing as it helps the brain to function normally. Oxytocin is sometimes called the ‘love hormone’ as it affects our ability to form personal relationships. Human interactions help to boost the levels of these healthy chemicals, which is partly why isolation and loneliness can be so harmful to mental wellbeing.

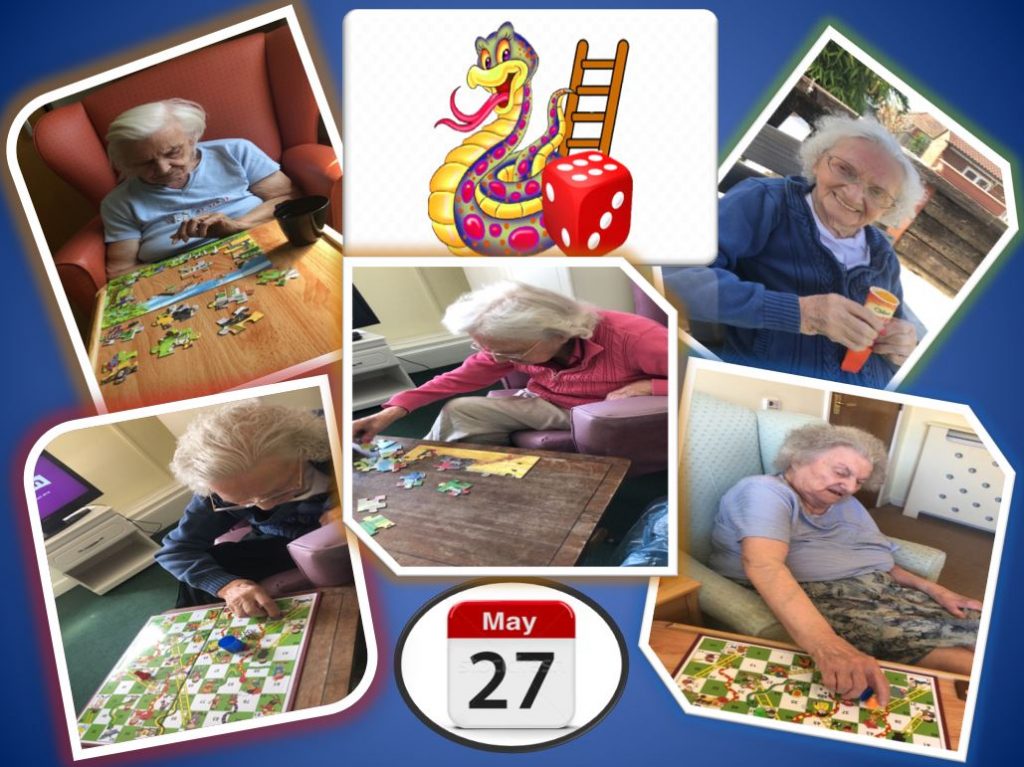

Participation in Meaningful Activities

Keeping active, doing something purposeful and interacting with other people have also been proven to help maintain good mental health. This won’t surprise anybody; but it can be a challenge to find the right types of activities that are accessible in later life. You have to wonder how much health spending could be saved by investing in more community activities for older people.

Physical Health

Physical health and mental health are closely linked. A good diet helps to boost the levels of healthy chemicals in the body and also provides the energy to take part in activities. Regular exercise is also important, whether that’s walking, gardening or a few gentle stretches with friends during the day.

Care providers have a vital role to play in promoting better mental health in older people. We need to work closely with health services and ensure we support people in our care with the right nutrition and activities. We’re also aware that we may be the first to notice the signs of mental health problems – so we need to make sure our people are trained in what to look for and what to do.

At Altogether Care, resident’s health and wellbeing are at the focus of what we do. If you would like to find out more about either our care homes, care at home or our live-in care services please get in touch.